Closing Bell — Mortgage Rate Recap

November 12, 2025

NMLS #257781 · Peoples Bank & Trust

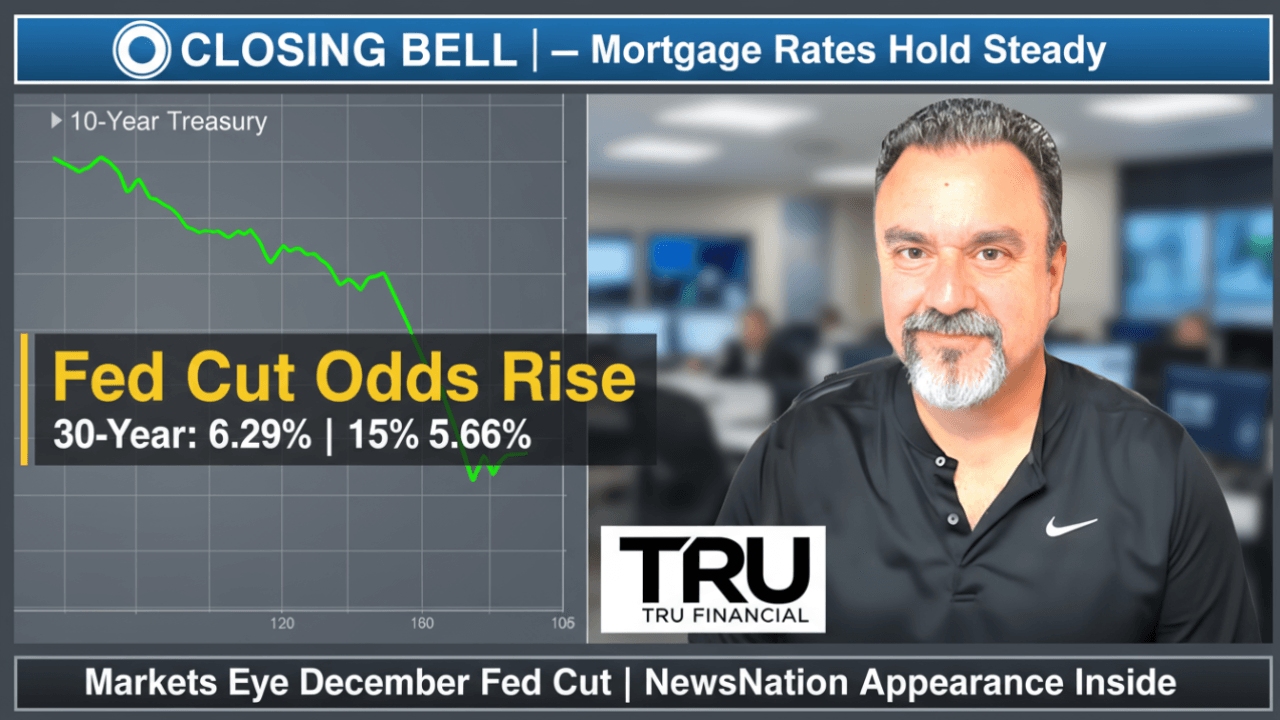

10Y UST: ↓ supportive for MBS

Fed Watch: Cut odds rising

Market Mood: Rates steady-to-softer

Today’s National Averages

30‑Year Fixed (APR) — Forbes

Methodologies differ (survey timing, points, APR). Use these tiles as an educational range, not a single‑lender quote.

What Happened

30‑year fixed mortgage rates held in the mid‑6% range, with MND at 6.29% (−5 bps), Bankrate at 6.25%, and Forbes APR at 6.34%. 15‑year fixed averaged about 5.66%, up a touch.

Why It Happened

- Bond yields eased/steady: Softer 10‑year Treasury yields supported mortgage‑backed securities, nudging rates lower or flat.

- Fed expectations: Markets priced a higher probability of a December rate cut amid cooling labor data, capping longer‑term yields.

- Data‑dependent pause: With key inflation/jobs updates ahead, lenders stayed tight on pricing, limiting big swings.

Sources: MND, Bankrate, Forbes Advisor, Reuters economist polling.

What To Watch Next

- Upcoming inflation and jobs data that could shift December Fed odds.

- MBS/Treasury spread behavior—room for rates if spreads compress.

- Lock vs float decisions based on timeline and payment comfort.

Buyer & Homeowner Playbook

- Buyers: If the payment fits, consider locking; shop lenders and points for best‑execution.

- Refinance: Rate‑and‑term can pencil out if you drop ~0.5–1.0% and recoup costs within your horizon; otherwise set a rate‑drop alert.

- Outlook: Direction hinges on inflation and the December Fed decision.