Data Point

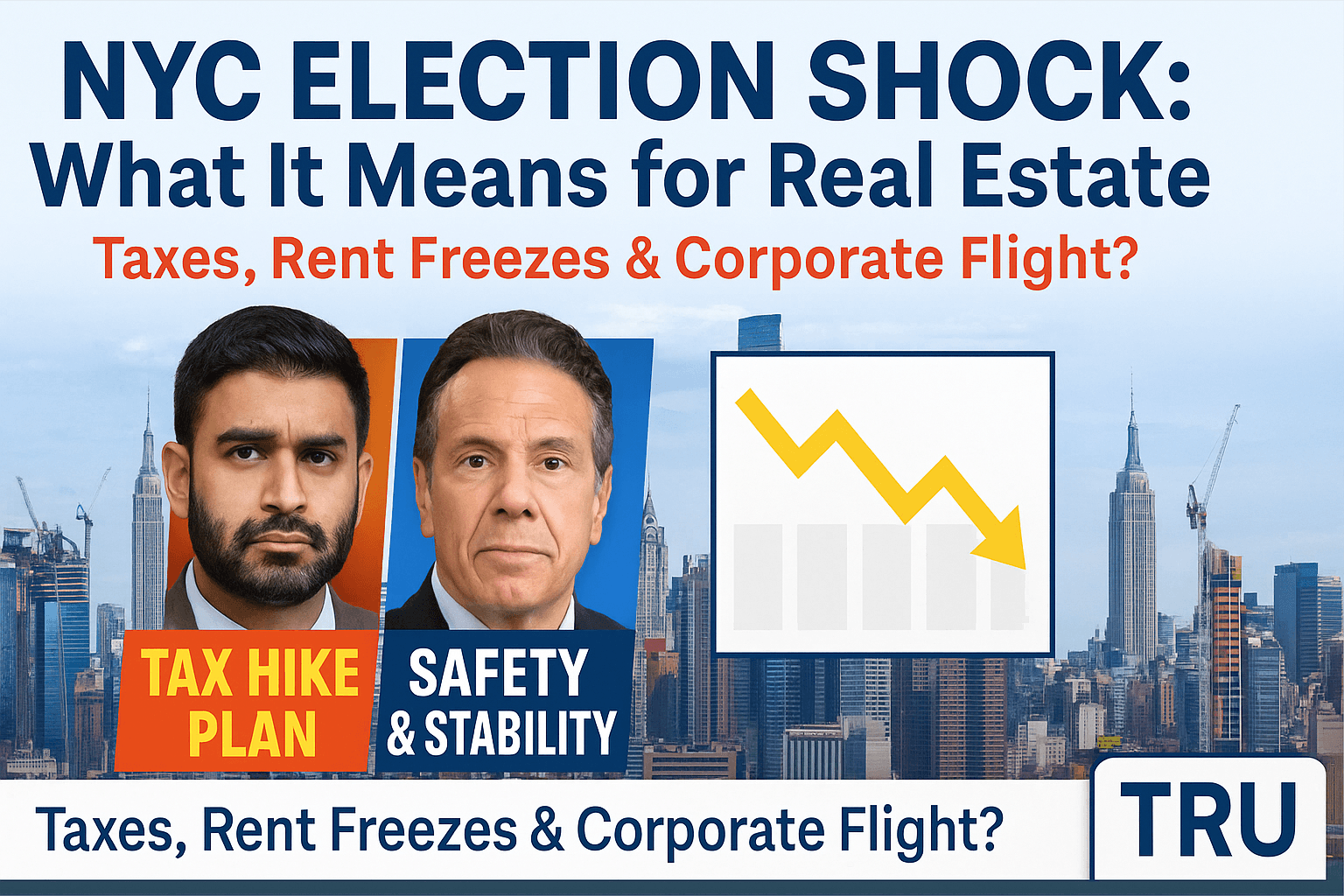

Zohran Mamdani

Andrew Cuomo

Corporate / Business Taxes

Supports higher top corporate rate (talked-about band up to ~11–11.5%) to fund affordability & services Headwind

Signals no new tax hikes focus; maintain competitiveness Supportive

Rent‑Stabilized Policy

Advocates rent freeze / stronger tenant protections → constrained NOI growth Risk

No freeze pledge; status‑quo leaning → NOI driven more by macro than new rules Neutral

Affordable Housing Supply

Scale up subsidized production; public‑private partnerships likely required Opportunity

Potential to unlock public parcels (e.g., site repurposing) with fewer new mandates Mixed

Development Incentives

More subsidy layers; union & compliance requirements likely higher Mixed

Incentives via zoning/land reuse more likely than new taxes Supportive

Luxury / High‑End Resi

Potential demand cooling via tax/regulatory overhang Headwind

Sentiment tailwind if public safety & brand stabilize Supportive

Multifamily — Market‑Rate

Stronger tenant tilt; underwriting shifts to lower leverage & higher DSCR Mixed

More predictable path for rent growth (macro‑dependent) Supportive

Office / Retail Leasing

Higher corp costs could weigh on demand at the margin, esp. B/C office Risk

Business‑friendly posture may aid leasing recovery Supportive

Public Safety / Operations

Less centered on policing growth; focus on social services Mixed

Emphasis on NYPD staffing & operations; tourism/foot‑traffic sensitive sectors benefit Supportive

Regulatory / Policy Risk

Higher (tax & rent policy changes require Albany; timing uncertain) Elevated

Lower (fewer new fiscal changes signaled) Lower

Best‑Fit Strategies

Workforce MF near transit; public‑finance stacks (LIHTC, bonds); efficiency‑led value‑add

Hospitality/Retail recovery; Class‑A office with amenities; market‑rate MF growth