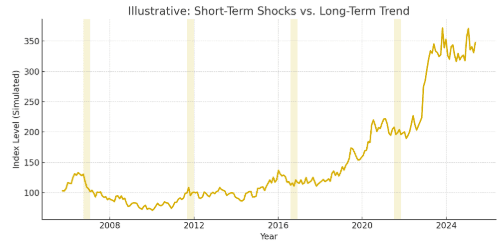

1) Government Shutdowns & Markets

Key message: Volatility ≠ Collapse. Shutdowns historically end; markets often normalize. Focus on a long‑term plan instead of headline‑driven trades.

2) Stay the Course with a Monthly Budget

Pick a number you will invest every month — no matter what headlines say. Automate it. This is the core of a durable plan for new investors.

- Rule #1: Decide your monthly amount and automate it on the same day each month.

- Rule #2: Use broad, low‑cost funds (e.g., total market or S&P 500 index).

- Rule #3: Revisit the plan annually, not daily.

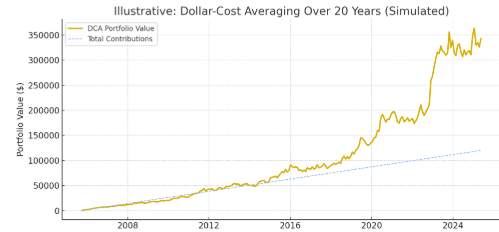

3) Dollar‑Cost Averaging (DCA) — 20‑Year Illustration

This example shows investing a fixed amount monthly into a broad equity index for 20 years. The solid line is your portfolio; the dashed line is your total contributions. Simulated data, for education only.

Assumptions: $500/month, 8% avg annual return, 18% annual volatility.

Illustrative outcomes: Total contributions = $120,000, Ending value = $343,065, Gain = $223,065 (simulated).

4) Live DCA Calculator

Adjust the assumptions to show how a rules‑based monthly plan compounds over time. (All calculations happen in your browser.)

5) Practical Checklist for New Investors

- Write down your monthly investing amount and automate it.

- Choose a broad, low‑cost fund (S&P 500 / Total Market).

- Rebalance once per year.

- Keep 3–6 months of expenses in cash so you don’t have to sell during volatility.

- Ignore headlines. Focus on your 5–10+ year horizon.