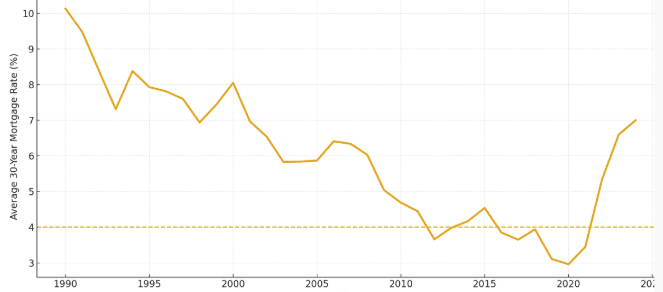

Source: Freddie Mac PMMS (annual averages, approximated for visualization). Dashed line marks a 4% benchmark.

Key Takeaways ✍️

- 1990s: mostly 6–9% — 4s were unicorns 🦄

- 2000–07: mid‑5s to low‑6s during boom 🔁

- 2010s: QE era brought 3s–4s 📉

- 2020–21: pandemic trough near ~3% 🧊

- 2022–24: inflation + supply = 6s–7s 🔥

Talking point: “4%” appears when inflation is anchored ~2% and the Fed is easing 🎯

Path Back to the 4s 🧭

- Inflation drifting to ~2% (core services cooling) 🧮

- Fed cuts + tighter term premium ✂️

- Slower growth without credit stress 🧯

- Less Treasury/MBS supply or stronger demand 📈

Watch: CPI/PCE • Jobs • 10‑Yr • MBS spreads 👀

Buyer Playbook 🧩

- Plan payments at today’s rate; treat sub‑5% as upside 📊

- Use seller credits / buydowns to bridge affordability 🧾

- Lock‑and‑shop now; refi when spreads compress 🔒➡️🔓

- Improve credit + DTI to hit best‑execution pricing ⭐

Live Q&A Prompts 🎤

- “Were the 4s normal?” → Only in QE/post‑crisis windows ⏳

- “6s → 5s?” → Inflation, Fed, spreads, supply ⚙️

- “When?” → Data‑dependent; watch 10‑yr & MBS OAS ⌛

Clip this: “You buy the home; you refinance the rate when math allows.” 🎬

This Week’s Market Radar 🛰️

- Key releases: CPI/PCE • Jobs • ISM • FOMC minutes 📅

- Watch the 10‑Year and MBS spreads for rate direction 🧭

- Headlines to cite: Yahoo Finance, CNBC, Mortgage News Daily 📰

Featured Media Appearances — Dan Frio in the News 🎥