Shutdown Watch

How a Government Shutdown Hits Mortgage Rates & Markets

Today’s Takeaway

- Shutdown risk is elevated; markets typically see a flight-to-safety bid into Treasuries in the early innings.

- That can nudge 10-year yields lower short-term, helping mortgage rates drift down — while processing frictions (IRS/SSA/USDA/FHA) can slow closings.

- Longer or messier standoffs can widen MBS spreads and re-apply upward pressure to rates.

History Snapshot

| Episode | Short-Term | Longer-Run |

|---|

| 2013 (16 days) | Rates ↘ / Volatility ↗

Processing bottlenecks for FHA/USDA/IRS verifications. | Levels normalized post-deal; path returned to macro/inflation trends. |

| 2018–19 (35 days) | Rates mixed

Longest shutdown on record; broad admin disruptions. | Market effects faded; costs absorbed into growth/deficit outlook. |

Historical analyses often show 10-yr yields flat to lower during shutdowns, with impacts fading after funding resumes.

Risk Map

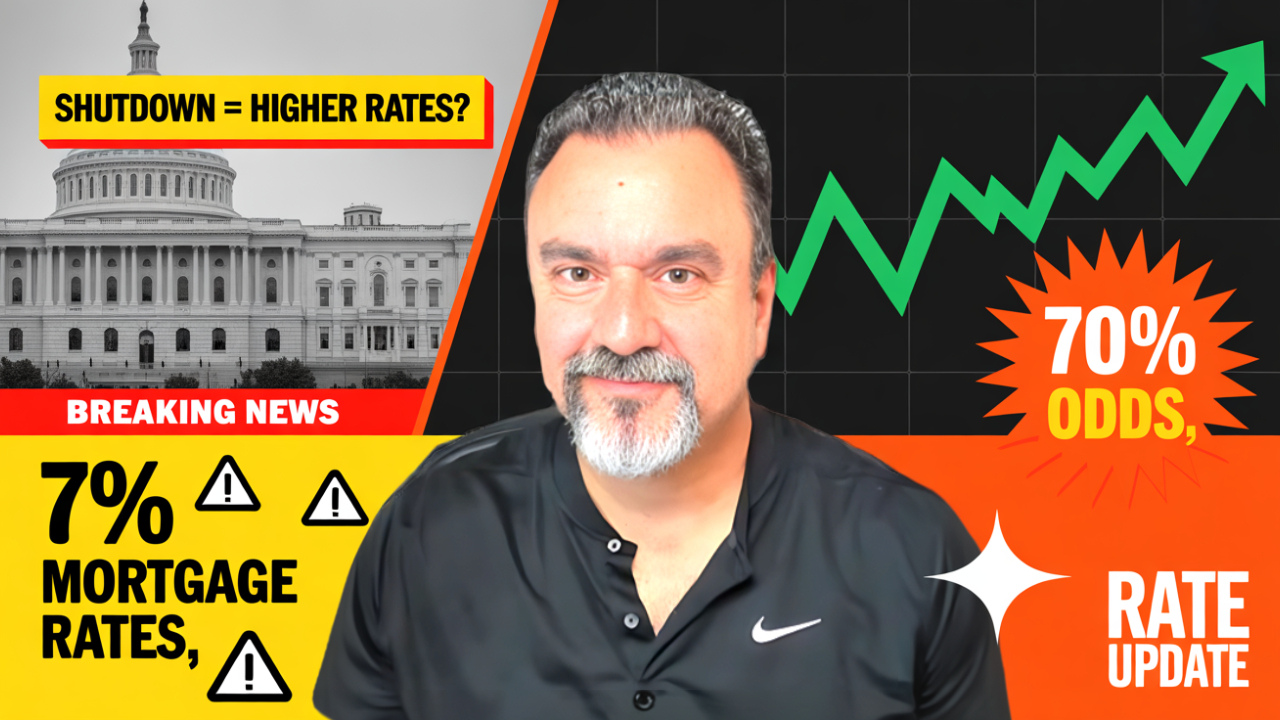

What Would Push Mortgage Rates Back Toward 7%?

- 10-yr Yield Rebounds on credit/fiscal worries or data surprises.

- Sticky Inflation keeps the Fed cautious; slower easing path.

- Wider MBS Spreads from volatility or investor risk aversion.

- Geopolitical / Policy Shocks that sour bond demand.

Quick lens: Watch the 10-yr yield (~4%–4.5% band lately) and primary/secondary spreads; if yields rise and spreads don’t compress, 7% talk returns.

Most Possible Outcome

🔮 Most Possible Outcome: Path to Below 6% Mortgage Rates

- 10-yr Yield ~3.5% on a sustained basis (not a one-day dip).

- Core inflation trending durably toward 2% (CPI/PCE).

- Fed signaling a path of cuts, not one-and-done.

- Tighter mortgage spreads as volatility cools and MBS demand firms.

- No new shocks (tariffs/escalations) that re-widen spreads.

We’ll break down each ingredient on tomorrow’s Opening Bell and track progress weekly.

Tools

Lock or Float? Stay Notified

Use the TRU Rate Watch to get a personalized alert when your target refinance rate is in reach.

- If you’re closing in less than 30 days: Our suggestion is to LOCK your rate.

- If you’re more than 30 days out: Subscribe to The Rate Update Channel and sign up for our Rate Watch Tool to track opportunities.

Contact & Disclosures

Connect with Dan Frio — The Rate Update (TRU)

Email: Dan@therateupdate.com

Website: therateupdate.com

YouTube: @TheRateUpdate

Required Disclosures

- For educational purposes only. This is not a commitment to lend. All loans subject to credit approval, underwriting guidelines, and available program terms.

- Rates and terms subject to change without notice and may vary based on credit score, loan-to-value (LTV), occupancy, property type, and other factors.

- APR vs. Rate: Annual Percentage Rate (APR) may differ from note rate due to fees and points; a full Loan Estimate will provide details specific to your scenario.

- Third-party verifications: Government shutdowns can delay IRS transcripts, SSA verifications, USDA/FHA/VA processing, flood insurance, and related services.

- Equal Housing Lender. 🏠

- Licensing: Company Name, Company NMLS #XXXXXX, Loan Officer NMLS #XXXXXX. (Update with your exact details.)

- Privacy: Do not send sensitive personal information via unsecured email. Contact us for secure document upload options.