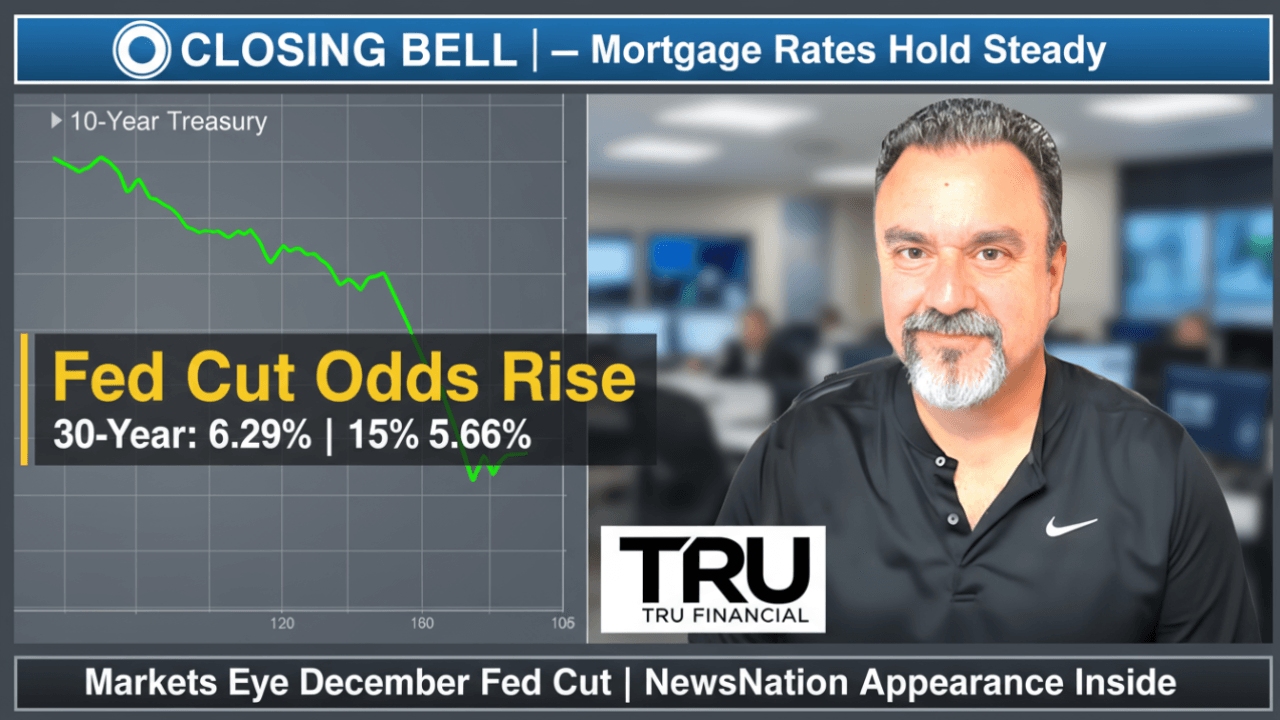

Mortgage rates hovered in the mid-6% range today, with the 30-year fixed averaging around 6.25–6.30% and the 15-year near 5.66%. Softer Treasury yields and growing expectations for a December Federal Reserve rate cut helped keep borrowing costs stable. Dan Frio breaks down what’s driving the bond market, how it impacts homebuyers and homeowners, and what to watch next in his latest Closing Bell recap — plus, don’t miss his NewsNation interview on whether a proposed 50-year mortgage is good or bad news for buyers.

The Trump administration says it’s exploring 50-year mortgage options to help with affordability. Learn what this could mean for homebuyers, monthly payments, and long-term costs.

Fannie Mae’s new credit score policy lets lenders use automated approvals even for borrowers below 620. Here’s what that means for homebuyers who thought they couldn’t qualify.

Mortgage rates dipped, then jumped after the Fed’s cut. A $15B corporate bond sale and stronger economic reports added pressure. Here’s the simple, kid-level way to understand what’s happening and what it means for buyers.

NYC Election 2025: What’s Next for Real Estate Investors The New York mayoral election could reshape the city’s entire investment landscape. Zohran Mamdani’s progressive housing and tax proposals signal higher corporate rates and tighter rent controls, while Andrew Cuomo’s platform leans on public safety and a steady tax environment. This episode breaks down how each outcome could impact commercial, multifamily, and luxury housing markets — and where the smartest capital might flow next.

“Despite weaker manufacturing data, mortgage rates moved higher today — a sign that bond markets may be anticipating stronger inflation or tighter future policy, pushing Treasury yields and mortgage pricing up.”

Veterans earned their benefits—but too often, big lenders and servicers turn those same benefits into profit engines. From CFPB enforcement actions to BBB complaints and reports of high-pressure sales, today’s VA refinance market is showing cracks in transparency. This deep dive pulls real data and government reports to expose what’s happening behind the scenes—and how veterans can protect themselves from hidden fees, predatory tactics, and deceptive “no-cost” promises.

The Federal Reserve cut rates again, but mortgage rates actually rose. Learn why this happens, what Powell said, and what it means for homebuyers.

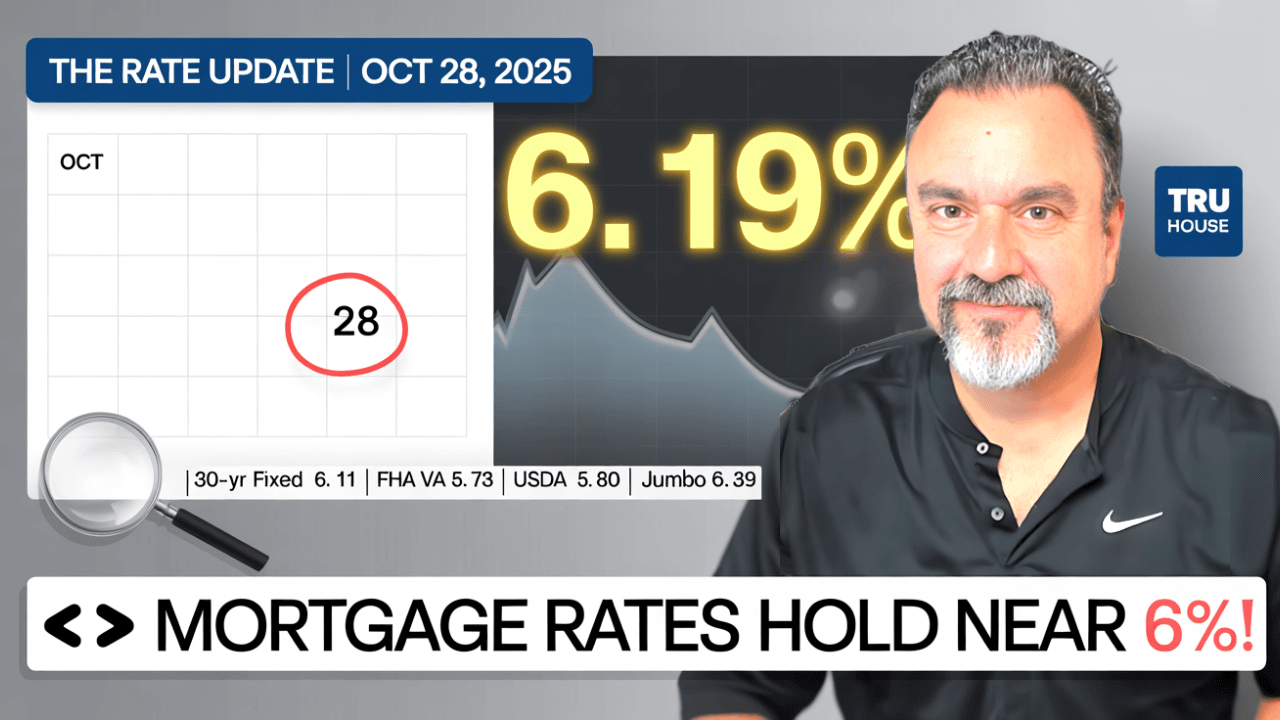

Mortgage rates steadied Tuesday as markets digested new housing data and awaited Case-Shiller’s latest home-price report. As of October 28, 2025, national averages show: 30-year fixed: 6.19% FHA: 6.11% VA: 5.73% USDA: 5.80% Jumbo: 6.39% With inflation cooling and Treasury yields dipping below 4.3%, borrowers are once again seeing sub-6% quotes for top-tier scenarios — a positive sign for late-year buyers and refinancers.